How to Change Tax Code

In most cases, HM Revenue and Customs (HMRC) will automatically update your tax code when your income changes. This information is typically obtained from your employer. However, sometimes the information HMRC has may be incorrect, leading to an incorrect tax code.

Steps to Correct Your Tax Code

1. Check and Correct Your Information

Verify Income Details: Ensure HMRC has accurate and up-to-date information about your income. You can do this through the Check your Income Tax online service.

Update Employment Details: Inform HMRC of any changes in your employment or income, such as:

Adding company benefits.

Reporting missing employers or income sources.

Claiming employment expenses.

Updating your estimated taxable income.

2. Using the Online Service

If you think your tax code is wrong, use the Check your Income Tax online service to:

Update your employment details.

Notify HMRC of any changes in your income that may have affected your tax code.

Example Updates:

Adding company benefits like a company car.

Reporting income from a new employer or additional job.

Claiming allowable employment expenses, such as work-related travel.

Adjusting your estimated taxable income for the year.

HMRC may change your tax code based on the updates you provide through the online service.

3. If You Cannot Use the Online Service

If you’re unable to use the online service, you can contact HMRC directly. Provide them with the necessary details to correct your tax code.

Contact HMRC:

Phone: Call the HMRC helpline.

Mail: Send a letter with your details and corrections.

4. After Updating Your Details

After you update your details, HMRC will:

Inform you if your tax code has been changed.

Notify your employer or pension provider of the new tax code.

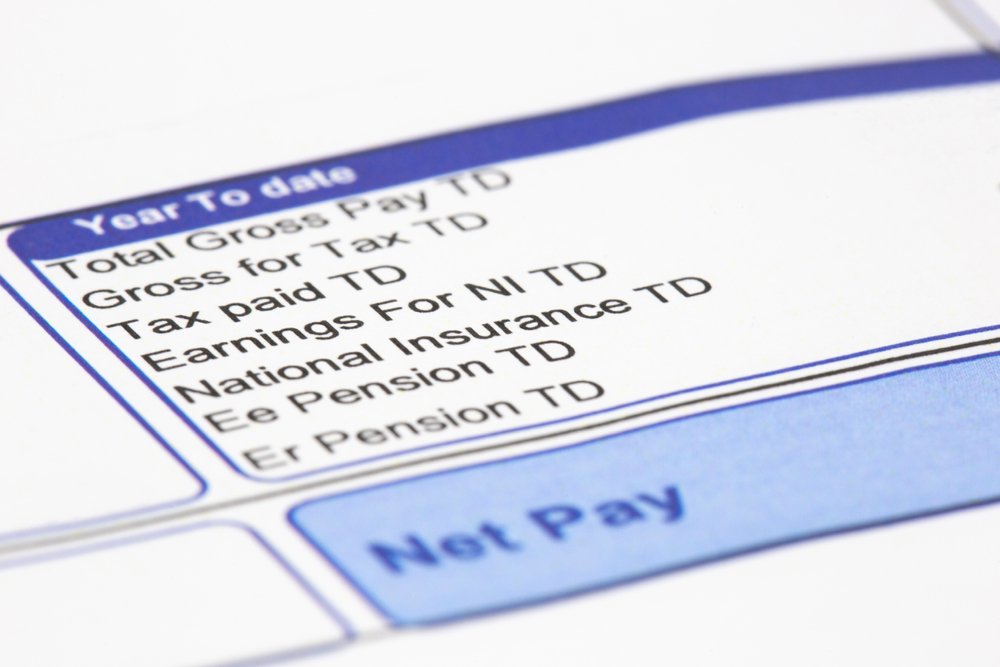

Your Next Payslip:

New Tax Code: Should reflect the updated tax code.

Adjustments: Any necessary adjustments to your pay if you were paying the wrong amount of tax previously.

Emergency Tax Code

If you are on an emergency tax code, you may need to take additional steps to correct it. Check what you need to do if you're on an emergency tax code by visiting the HMRC website.

Helping Someone Else

If you need to update the tax code for someone else, such as a client or a family member, fill in a PAYE Coding Notice query form.

Tax Refunds and Payments

At the end of the tax year, if you've paid too much or too little tax, HMRC will send you:

P800 Tax Calculation Letter: If you’ve overpaid or underpaid tax.

Simple Assessment Letter: Detailing what you owe or what will be refunded.

Summary

To ensure your tax code is correct:

Regularly check and update your income details with HMRC.

Use the Check your Income Tax online service to make updates.

Contact HMRC directly if you can't use the online service.

Monitor your payslips for changes and adjustments.

By keeping your tax code accurate, you can avoid underpaying or overpaying taxes and ensure compliance with HMRC regulations.

Other Articles

What is Employment and Support Allowance?

Let us Handle Your Payroll

Our team of tax specialists are here to help you every step of the way, from registering you as an employer to submitting monthly and yearly returns to your staff and HMRC. We offer fixed priced accountancy services and handle all of your filing responsibilities leaving you stress free and up to date.

Whether you already operate as an employer or are thinking of setting up a business, give us a call today for a free non obligated consultation to see how we can assist you.